Your Paycheck Stub and Wage and Hour Laws

A paycheck stub is an essential document that accompanies every paycheck, providing a detailed breakdown of the employee’s earnings and deductions. This stub serves as proof of income and ensures transparency in wage calculations. Understanding your paycheck stub is crucial for ensuring accurate payments and adherence to wage and hour laws. In this article, we will explore the key components of a paycheck stub and discuss relevant wage and hour laws.

Components of a Paycheck Stub:

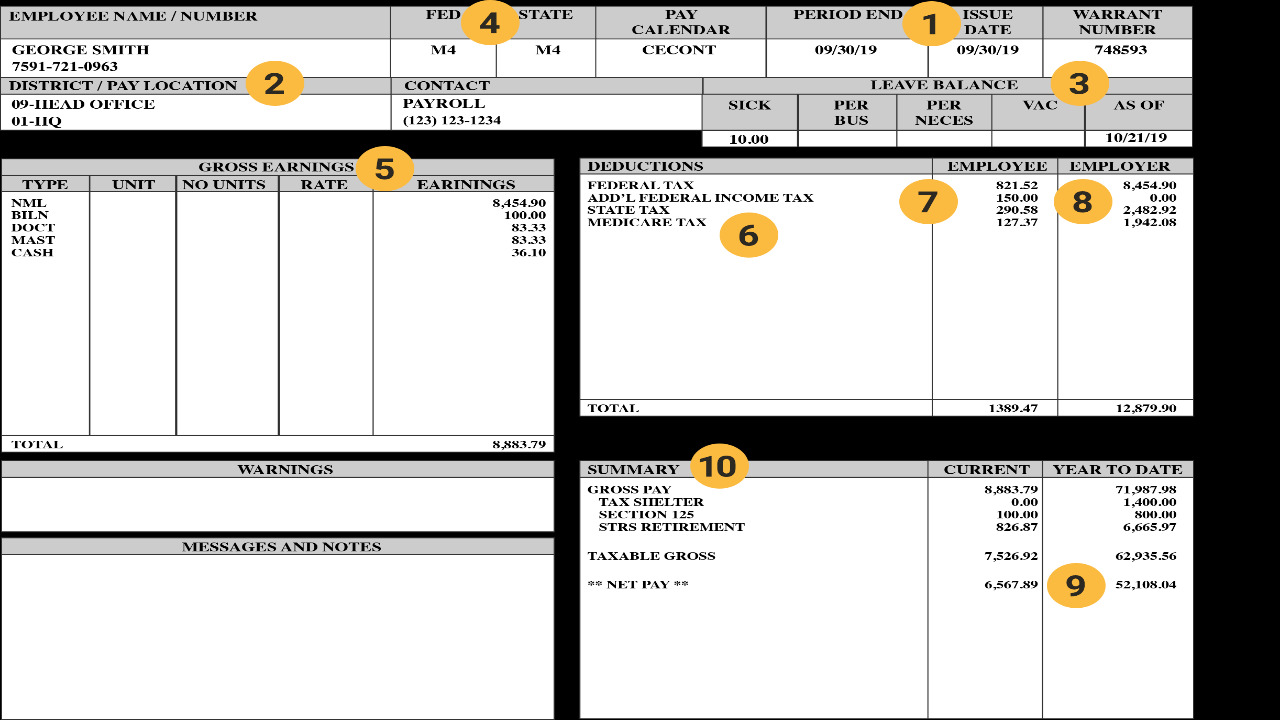

A. Employee Information:

The paycheck stub typically includes basic employee information such as name, address, and Social Security number. This section helps identify the recipient of the paycheck and ensures accuracy in recordkeeping. If you need quality paycheck stubs, try a paystub creator from PayStubCreator.net!

B. Earnings:

This section outlines the employee’s earnings for the pay period. It includes details such as regular wages, overtime pay, bonuses, and commissions. Each earning category should be clearly specified, enabling employees to verify the accuracy of their payments.

C. Deductions:

Deductions on a paycheck stub include various items that reduce an employee’s net pay. These deductions may include federal and state income taxes, Social Security and Medicare contributions, health insurance premiums, retirement plan contributions, and other voluntary deductions. A detailed breakdown of each deduction allows employees to understand how their net pay is calculated.

D. Hours Worked:

If applicable, the paycheck stub may include the number of hours worked during the pay period. This information is especially important for hourly employees who are entitled to overtime pay under certain circumstances. Accurate tracking of hours worked helps ensure compliance with wage and hour laws.

E. Benefits and Leave Balances:

Some paycheck stubs provide additional information regarding employee benefits and leave balances. This section may include details on vacation days, sick leave, personal time off, and other accrued benefits. Employees can monitor their available balances and plan their time off accordingly.

Wage and Hour Laws

A. Minimum Wage:

Wage and hour laws establish the minimum wage that employers must pay their employees. The purpose is to ensure fair compensation and protect workers from exploitation. It is essential for employees to review their paycheck stubs to verify that they are receiving at least the minimum wage for hours worked.

B. Overtime Pay:

Under wage and hour laws, eligible employees are entitled to overtime pay for any hours worked beyond the standard 40-hour workweek. Overtime pay is usually calculated at a rate of one and a half times the regular hourly wage. Paycheck stubs should reflect accurate overtime calculations to ensure compliance with the law.

C. Breaks and Meal Periods:

Certain jurisdictions have laws that require employers to provide rest breaks and meal periods to their employees. These laws may specify the duration and frequency of breaks based on the number of hours worked. Paycheck stubs can help employees monitor whether they have been granted the appropriate breaks as mandated by law.

D. Recordkeeping:

Wage and hour laws often impose recordkeeping requirements on employers. This includes maintaining accurate records of employees’ hours worked, wages paid, and deductions made. Paycheck stubs serve as crucial evidence in case of disputes or audits, as they provide a comprehensive record of earnings and deductions.

E. Payroll Errors and Discrepancies:

Regularly reviewing your paycheck stub allows you to identify and address any payroll errors or discrepancies promptly. If you believe there is an error in your pay, it is important to communicate with your employer or the payroll department to rectify the issue. Prompt action helps protect your rights under wage and hour laws.

Conclusion

Understanding your paycheck stub is vital for ensuring accurate payments and adherence to wage and hour laws. By familiarizing yourself with the components of a paycheck stub and regularly reviewing it, you can identify any discrepancies or errors in your pay. Additionally, knowledge of wage and hour laws empowers you to assert your rights as an employee and seek resolution for any violations.