Numbers That Matter: Analyzing Accountant Salaries and CPA Designations

In the world of finance and business, accountants play a crucial role in managing financial records, ensuring compliance, and providing valuable insights to aid decision-making. One of the key indicators of an accountant’s career success is their salary, which can vary significantly depending on various factors. Additionally, the Certified Public Accountant (CPA) designation is a highly sought-after qualification that can significantly impact an accountant’s career trajectory and earning potential. In this article, we will delve into the numbers that matter in the realm of accountant salaries and the importance of the CPA designation.

Factors Affecting Accountant Salaries

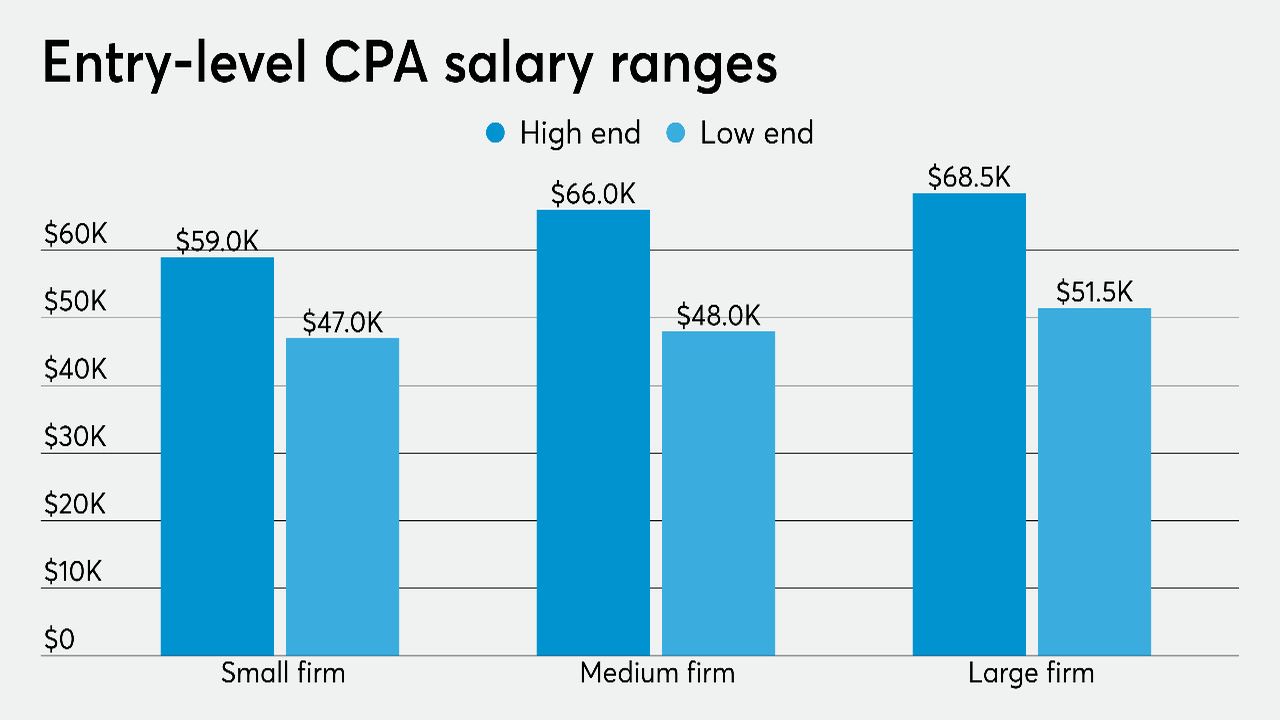

Numerous factors influence the salaries of accountants. These factors may include education, experience, geographic location, industry, and the size of the employing firm. A bachelor’s degree in accounting or a related field is typically the minimum educational requirement for entry-level positions. However, candidates with advanced degrees, such as a Master’s in Accounting or an MBA with a focus on accounting, often command higher salaries. To assess your accountant salary, you can use https://www.thepaystubs.com/w2-form-generator and learn all your financial information.

Experience is another critical factor. As accountants gain more experience and expertise, their salaries tend to increase. This is especially true for those who demonstrate exceptional skills in financial analysis, tax planning, or auditing.

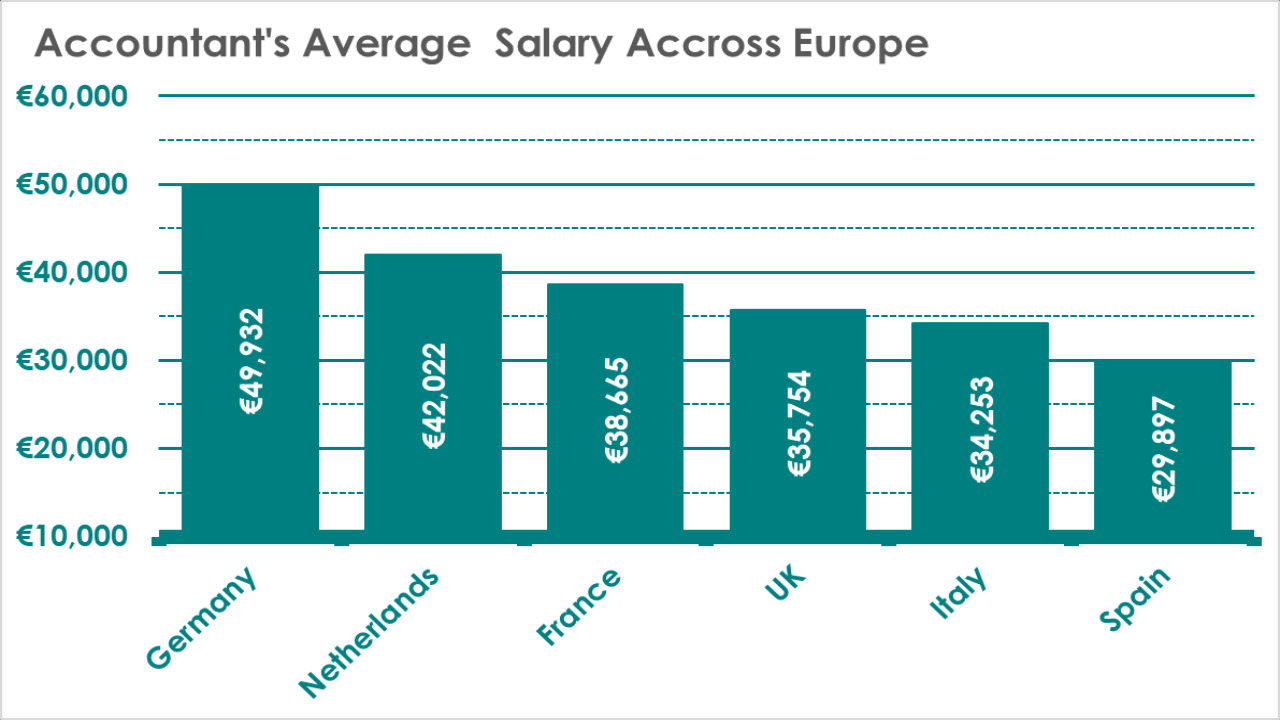

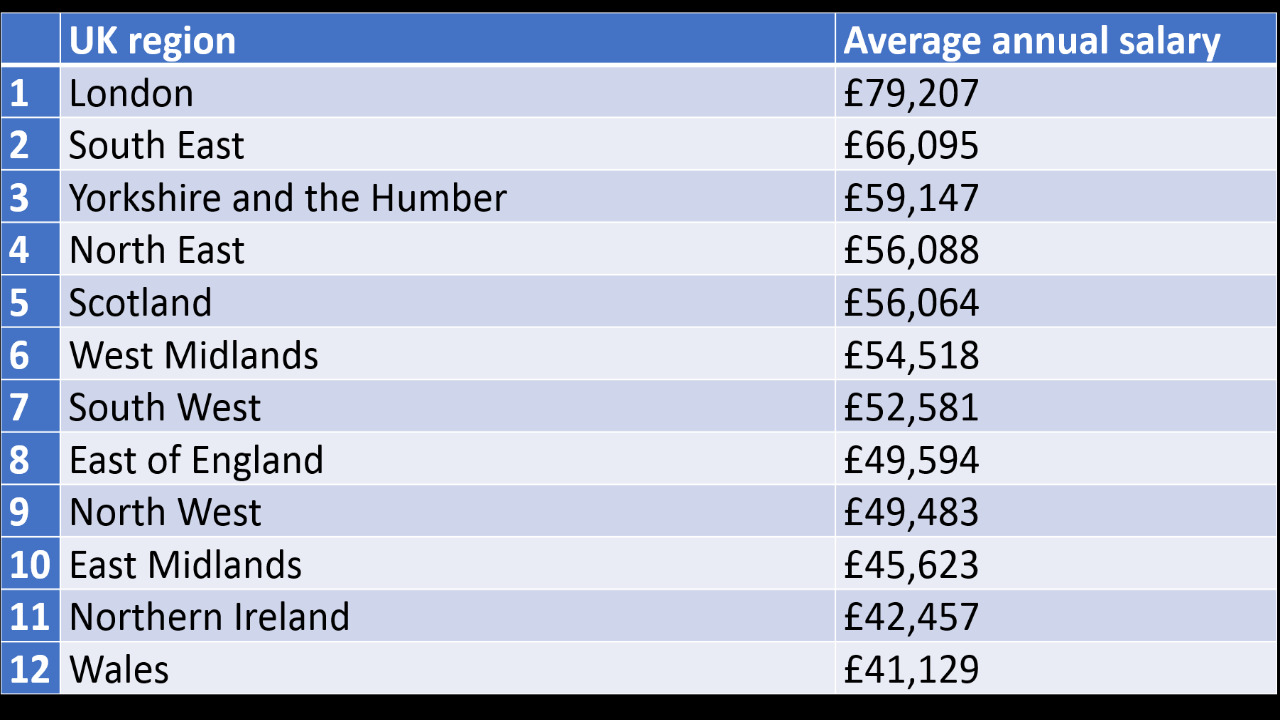

Geographic location also plays a significant role in determining accountant salaries. Accountants working in metropolitan areas or regions with a high cost of living usually earn higher salaries compared to their counterparts in rural or less densely populated areas.

Furthermore, the industry in which an accountant works can impact their earnings. For instance, accountants in the finance or healthcare sectors often earn more than those in the nonprofit or government sectors.

CPA Designation and Its Impact on Salaries

The Certified Public Accountant (CPA) designation is one of the most prestigious and recognized certifications in the accounting profession. To become a CPA, accountants must pass a rigorous exam that assesses their knowledge and proficiency in various accounting disciplines. Attaining a CPA designation is a significant achievement and can open up a plethora of career opportunities.

Research consistently shows that CPAs tend to earn higher salaries compared to non-CPA accountants. Employers often view the CPA designation as a testament to an accountant’s expertise and commitment to their profession, making them more valuable assets to the organization.

Beyond the immediate financial benefits, the CPA designation can also lead to quicker career advancement. Many management and leadership positions in accounting and finance require or prefer candidates with a CPA qualification. Thus, CPAs may find themselves on a faster track to becoming financial managers, controllers, or even CFOs.

Regional Disparities in Accountant Salaries and CPAs

As previously mentioned, geographic location significantly impacts accountant salaries. This notion holds true for CPAs as well. The average salary of a CPA can vary significantly from one region to another due to differences in the local economy, demand for accounting professionals, and cost of living.

For instance, CPAs working in major financial hubs like New York City or San Francisco generally earn higher salaries than those in smaller cities or rural areas. This trend is partially driven by the higher concentration of large corporations and financial institutions in such metropolitan areas.

Industry-Specific CPA Compensation

The significance of the CPA designation may also differ by industry. While CPAs in all sectors enjoy higher earning potential compared to non-CPAs, some industries offer more substantial financial incentives to those with the certification.

For example, CPAs working in public accounting firms often receive higher salaries, especially if they are involved in auditing, tax consulting, or advisory services. The demand for specialized skills and the complexity of projects in public accounting contribute to these increased earnings.

In conclusion, accountant salaries and the value of the CPA designation are interconnected and critical aspects of a successful accounting career. Factors such as education, experience, location, and industry significantly influence an accountant’s earning potential. Earning the CPA designation not only boosts an accountant’s salary but also opens doors to more excellent career opportunities and advancement. Whether one is an aspiring accountant or a seasoned professional, understanding these numbers that matter can help make informed decisions about their career path and financial goals.